How was National able to take down construction so quickly?

How was National able to take down construction so quickly?

Written By:

- Date published:

7:51 pm, August 15th, 2025 - 65 comments

Categories: chris bishop, economy, erica stanford, housing, national, unemployment -

Tags: Construction industry, Kainga Ora, state housing

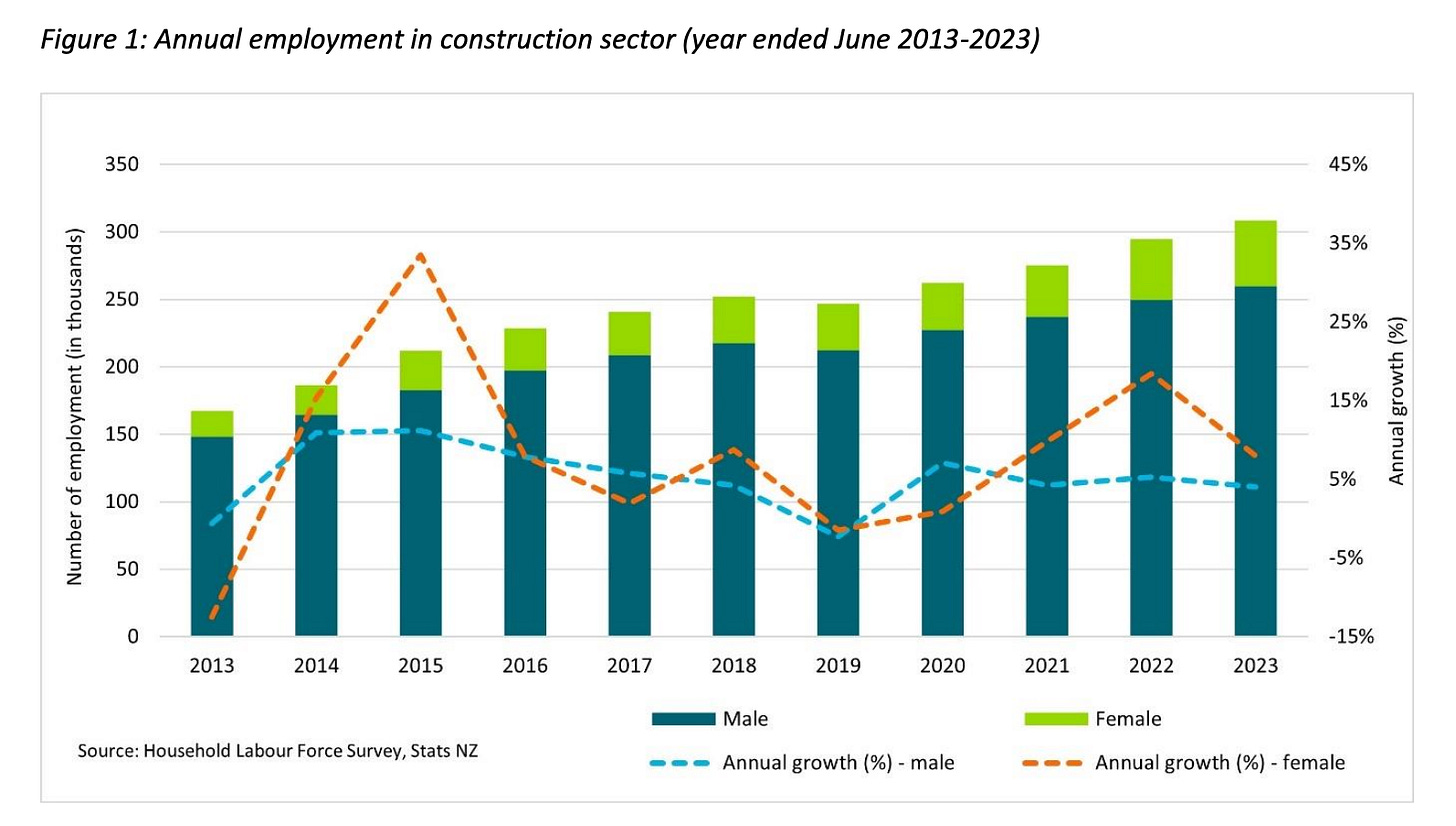

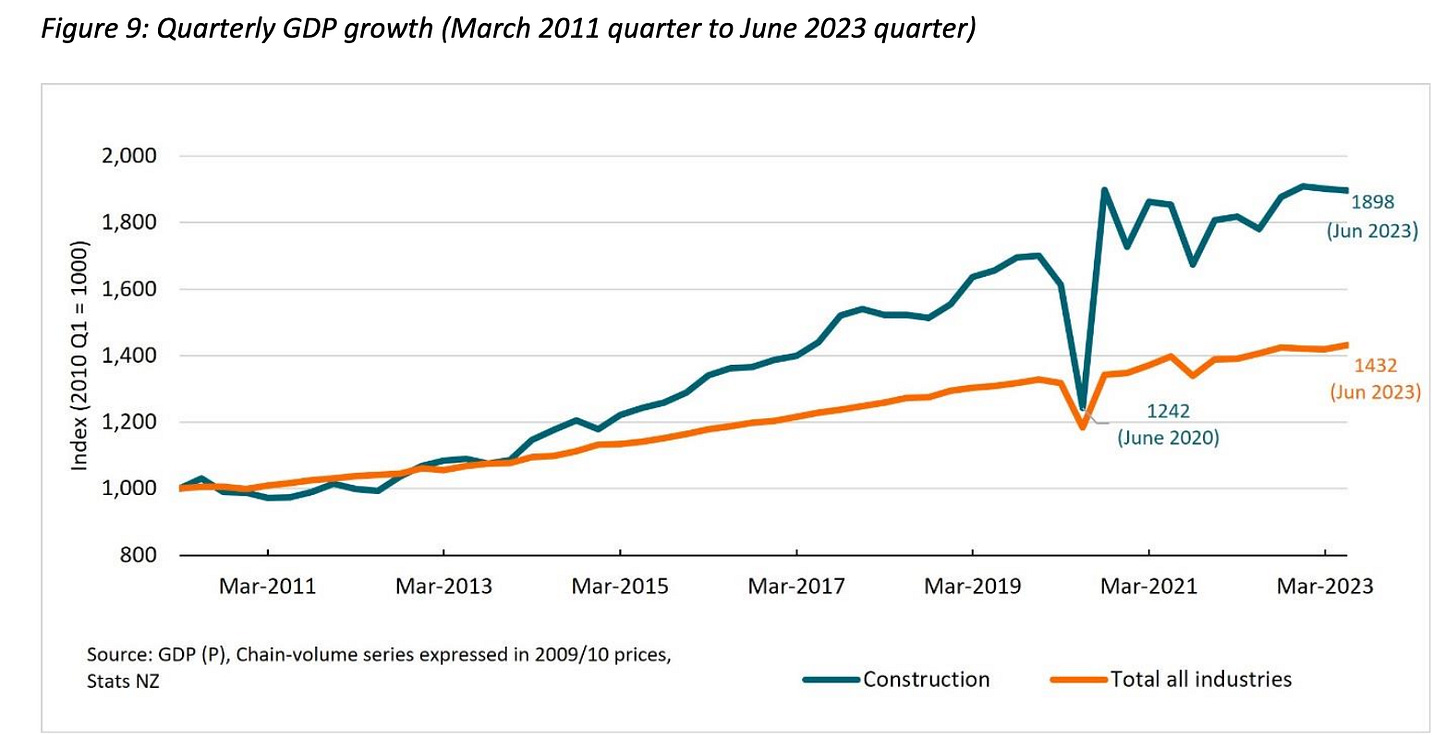

The construction sector is NZ’s fifth largest industry and has been in the top 5 in the last few years.

Its estimated to support ~11% of our workforce – i.e ~309,000 workers. And contributed around ~$26 billion NZD as at June 2024.

In 2023, the construction industry was worth 10 x that of the mining sector, which has been an underperformer for many years over both National and Labour governments

~95% of construction businesses are small businesses employing under 10 people.

And liquidations in the sector are skyrocketing – up 37% over the last year and accounting for 31% of all NZ’s liquidations.

And while Fletchers is NZ’s largest construction employer, Kāinga Ora is NZ’s largest home builder with e.g. 5299 homes on the books to build as at mid 2024.

It’s considered by many to be an anchor for the industry’s stability.

Construction is not limited to just homes. It relates to infrastructure e.g. water, transport, schools, hospitals etc. as well.

And that really underpins the story of how National was able to so quickly smash one of our largest industries – incurring a loss of 18,000 construction jobs and overseeing massive business failures – at a time when infrastructure debt is already esimated at around $210 billion, qualified resources are scarce, and the economy/employment continues to underperform.

How did we get here? Was it unexpected?

The short answer is “No”.

Once in office, National set about cancelling nearly every important infrastructure program in play.

- Three Waters, which immediately sunk $1.2 billion of taxpayer investment,

- Auckland Light Rail that saw sunk costs of $228 million,

- 100 new classroom builds were stopped when Erica Stanford put up a cost cutting “review”,

- $7.4 billion Let’s Get Wellington moving project was canned

- National also quietly shelved previously committed funds for hospital builds, only putting aside $103 million for $7.7 billion of work and stalling hospital construction across Nelson, Dunedin, Whangarei etc.

But perhaps one of the most significant moves was Chris Bishop’s Kāinga Ora hit job, which he paid Bill English $500,000 for, promising English there would be no public hearings and no need to even talk to Kāinga Ora.

Bishop’s “Kāinga Ora turnaround plan” was effectively culling it and its mandate.

At the time Dwell Housing Trust chief executive Elizabeth Lester told RNZ Bishop’s plan represented a net increase of “400 KO homes plus 750 community homes” and would hardly “make a dent” in the social housing register.

i.e. The inevitable effects of National’s policy actions were obvious, even if the flow through was not yet seen.

Did anyone know?

As usual, the warnings were in plain sight. Throughout 2024, construction leaders openly pleaded with Bishop to restart work.

Source: Stuff

Labour’s Kieran McAnulty ceaselessly warned on the same, and incidentally also pre-empted the significant Council rate hikes we are seeing around the country today after National repealed 3 Waters.

Source: Facebook

All of that fell on deaf ears.

So where are we now?

Post Journalist Thomas Manch has been covering construction stories of late.

Today Manch reports:

Kāinga Ora has more than halved the number of building contractors it employs as its house building programme shrinks. Another datapoint marking out the construction downturn…..

[Construction] Sector leaders have in recent weeks told The Post the state house building programme was an “anchor” for the construction sector.Across the construction sector, the cancelling of Government projects and dialling down of building to cut costs has been blamed for the depth of the downturn.

Kainga Ora plans to only build a net 420 homes in 2025. In typical fashion, Bishop is killing state housing by stealth and without the mandate to do so.

The industry’s message is increasingly clear:

New Zealand Certified Builders Chief Executive:

“The main catalyst behind all this is severely reducing the pipeline of work coming out of central Government.

“The best thing that the Government can do now is start opening up that pipeline of work again and signalling that it’s on its way, and it needs to arrive pretty smartly, because [of] the devastation to the industry.”

Civil Contractors NZ chief executive Alan Pollard:

“The challenge for us is that there is a gap in project work now, and you know, we have a number of our members, literally, with nothing on their books to do at all at the moment.”

“Towards late 2023 we were really busy, looking good. First quarter 2024 literally fell off a cliff.”

Pollard said the government’s pipeline caused this, and a turnaround could be 12 months away.

However, Chris Bishop continues to deny National has a role to play in the significant number of business liquidations and 18,000 unemployed over the last 18 months, claiming industry experts are simply “wrong”.

“You can fool some of the people all of the time, and all of the people some of the time, but you cannot fool all of the people all the time””

Bishop also said:

“We’ve had, obviously, some job losses, which no one wants to see.

But that is not on the Government, frankly.”

Frankly. How about “frankly”?

Mountain Tūī reports and breaks important political news – from Curia Market Research’s suspension to David Seymour’s scandal ridden school lunch provider to 2/3 of conservation land at risk. Thanks for your presence and support.

This post is a repost from Mountain Tui Substack

EXTRA

Construction has typically been a strong performer and saw steady growth

They took construction down by paying Bill English$500000 to write a "Report" on Kainga Ora, to give them the "reason" to stop the building programme. Plus they stopped most Infrastructure builds, saying we could not afford them.

Funny how they could "afford" tax cuts and payments and contracts for their mates.

They are "Private" and taking from the "Public" to feather the Private nests, which is the plan.

Has anyone noticed the bigger the government, the bigger the problems? Adding gst to the tax take without reducing wage/salary tax. Why does someone on the minimum wage pay income tax, when they're already paying 15% on essentials? It undermines self determination when you work full time and need support to just live under a roof.

The CoC is government by the sorted, for the sorted, and sorted "do not care."

Annual % increase in the minimum wage for the last wee while:

2015 – 3.5% (5th National (Key) government)

2016 – 3.4%

2017 – 3.3%

2018 – 4.8% (6th Labour (Ardern) government)

2019 – 7.3%

2020 – 6.8%

2021 – 5.8%

2022 – 6.0%

2023 – 7.1%

2024 – 2.0% ('our' CoC govt)

2025 – 1.5%

https://www.greens.org.nz/green_budget_2025

https://www.greens.org.nz/taxcalculator

The excessive minimum wage increases was self inflicted inflation by labour.

If you don't increase wages, people can't afford to buy the things they need and want. This has two impacts:

Inflationary, you say. Did Kiwi serfs think those increases were excessive?

Maybe you wouldn't either, if you were on minimum wage

Personally wouldn't be agin gradually lifting the minimum wage for adults (currently $23.50 / hr) to a living wage ($27.80; $28.95 from 1 Sept 2025).

Inflation and % increase in the minimum wage (MWI) for the last wee while:

Inflation – MWI

2015: 0.3% 3.5% (5th National (Key) government)

2016: 0.6% 3.4%

2017: 1.9% 3.3%

2018: 1.6% 4.8% (6th Labour (Ardern) government)

2019: 1.6% 7.3% [YAY!!]

2020: 1.7% 6.8% [YAY!!]

2021: 3.9% 5.8%

2022: 7.2% 6.0% [BOO!!]

2023: 5.7% 7.1%

2024: 2.9% 2.9% ('our' CoC govt)

2025: ????? 1.5%

Notice how inflation also dropped once national was in and stopped excessively increasing the minimum wage

Humt – just another ignorant fool making idiotic false assertions and trying to rewrite history because they are too lazy to look up actual data. Instead of using their brain they parrot another’s false line.

Have a look at the stats for the CPI https://www.stats.govt.nz/indicators/consumers-price-index-cpi/

The CPI peaked in the June 2022 quarter at 7.3%. By September quarter 2023 is was down to 5.6%, and December quarter 2023 to 4.0% (half before the election and half after).

But I suspect that you’re too lazy or afraid to look at real statistics. So here, I’ll show you the graph.

Currently it has risen from a low of 2.2% in Sept 24 quarter to 2.7% in June 25 and shows every sign of starting to rise as the economy continues to contract and local prices rise because of Nationals recession inducing policies.

BTW: Most of the inflation in late 2022 and 2023 was due to the continuing overseas inflation and supply constraints rather than excessive money sloshing around the local economy. In other words, it got more expensive to purchase overseas goods and services inside NZ and our production and retail prices rose according. There was some effect from the employment sustaining support. Mostly in fuelling a property boom, especially including increased rents as landlords and motels took advantage of housing constraints in a pandemic.

Hey. I have a bridge to sell you.

New Zealands minimum wage increases caused worldwide inflation. Yeah right!

If it is wages that put up prices, please explain why wage rises are always lagging way behind price rises?

Incorrect. They were well overdue.

It's housing new zealand no wonder we in so much debt stop the maori waste of funds 3 waters showing what happens when you put maori in charge money spend and nothing to show 4 it disgusting

[Letting this one through under probation because it’s such a beautiful example of RWNJ literary art, IMO – Incognito]

Pretty damn mindless. Especially when 3 waters never actually happened – it was cancelled before it was started, no debt was raised for it, and Maori weren’t running it.

Of course the water costs haven’t gone away. Now it is being doesn’t piecemeal and with rapid rises in costs to consumers with Nationals flawed infrastructure plans.

In fact there was an article in The Post (probably paywalled) yesterday “Surging cost of water services begins to become clear across New Zealand” by Thomas Manch

But it gets worse. No real economies of scale and there is a lot of selective picking of who to partner with.

What that means – look at Christchurch.

etc..

But getting back to the post. You have to ask where the councils are planning on getting their construction people from? Most of the skills have already departed to Australia because 3 Waters was cancelled. So now, almost 2 years later, we are only just starting to get plans on its replacement.

The residential construction sector is where most of the very small businesses are, and their downturn is mostly caused by the Reserve Bank's Debt to Income and Loan to Value Ratio restrictions, and deliberately causing a recession.

We can thank Adrian Orr for the residential construction recession.

I've been in construction for 30 years, what happens when govts decimate contracts is the big boys start competing for the medium contracts which pushes the medium companies into residential housing ( cutting margins to win contracts) and the little guys lose out as they can't compete. This may be a basic view ( I am after all just a builder) but it's what we see on the ground

Yes that's the same for my company.

Ha real world knowledge often trumps edumacated reckons!

That’s common nonsense; knowledge always trumps reckons. I think you may have a slightly misplaced view of anecdata, real-world ‘knowledge’, lived-in experience, first-hand experience, and the likes.

Yes, the residential building industry WAS booming which saw the price per square Metre go from 2500 to 4000 thanks in a good part to Labour's largess.

BK, the failure to fund the pipeline of contracts in public housing and infrastructure by the current Government has collapsed the system. It came as housing was beginning a price correction, which was then accelerated. When the LTV's came in, size and price needed to change, but often style and size of house was locked into suburb rules applied by developers trying to protect from mixed neighbourhoods. imo

Yes totally agree,

we voted national in to get rid of Labour and there outrageous leftist ideas , and country destroying polices.

Ardern and hipkins with there bad handling of the so called covid,paying people to sit at home on there arse.

And Now we have a government that does not understand the building industry.

Farming and the Construction industry are the back bone of Nz.

We watch these pathetic arguments in parliament.

How childish.

They need to get a real job

And know what it's like to actually put in a proper days work in all weather.

No work no pay ,not sitting inside some Cosy office making up emails.

Like most government jobs doing there fingernails and trying to look busy.and still getting paid in rain, hail and sunshine. (Air conditioning offices) while us Construction workers pay the wages.

I Finish with this country better wake up quickly as it's going to get worse.

Worse? Even with "so called covid" fading and our CoC at the helm? Outrageous!!

First home loans, Kāinga Ora and new builds exempt from DTIs and LVRs:

https://www.rbnz.govt.nz/regulation-and-supervision/oversight-of-banks/standards-and-requirements-for-banks/macroprudential-policy/loan-to-value-ratio-restrictions

This has been policy for 13 months (can't find it but these carve out might have also been in place prior to that) and the sector is getting worse so there is something else at play, ie government policy.

Look I'm first to agree this government broke the civil contractor industry.

But housing collapse IMHO is the Reserve Bank's fault mostly, plus a sustained recession at least as severe as post-1988 sharemarket collapse.

Very simplistic comment Ad. A 20% deposit on new loans is hardly draconian and there were compelling reasons to have such restrictions in NZ’s highly speculative and overvalued housing market.

As the Reserve Bank says:

"LVR restrictions support the stability of the housing market and help reduce the risk of a sharp correction in house prices. They also provide an additional buffer if a housing downturn were to occur, which would particularly affect highly indebted home owners and investors.

Housing lending makes up about half of bank lending in New Zealand….A sharp correction in house prices is therefore a significant risk to the financial system, which could negatively impact the functioning of the banking system and cause lasting damage to households and the wider economy.

Housing, like other asset markets, can be subject to ‘fire sale’ effects in a downturn, where indebted borrowers sell property to pay down debt, which in turn depresses prices and creates further incentives to sell and/or reduce spending and borrowing."

https://www.rbnz.govt.nz/regulation-and-supervision/oversight-of-banks/standards-and-requirements-for-banks/macroprudential-policy/loan-to-value-ratio-restrictions

20% of $800,000 average house =

$160,000

How many people under 50 will ever do that?

Very few.

As for the RB trying to prevent a correction, we’re in the worst one in 30 years.

Actually I think this is exactly the correction that was much needed. This article is relatively recent (Dec 24):

"Is Housing Affordable in NZ?

The short answer to that question is: no, not particularly. In fact, according to the World Population Review, NZ is one of the countries where buying a home is difficult. NZ even ranked as the sixth least affordable country to buy a house in 2022.

The same report found that housing in NZ, with an affordability ratio of 17.8%, was less affordable than 32 other countries. These include:

“Property prices have drastically increased over the years, especially in major cities like Auckland. This rise has outpaced wage growth, making it very difficult for many people to afford to buy a home.”

https://www.mpamag.com/nz/mortgage-industry/guides/is-housing-affordability-still-an-issue-in-new-zealand/517625

You're saying our housing is more affordable in this scale of recession?

House sales are through the floor. Auckland won't recover in the foreseeable.

Large numbers of NZ sales are "underwater" with their mortgages. That's devastating families.

That doesnt show affordability.

If housing was affordable now they wouldn't depart in their tens of thousands.

Also not helped by Kiwisaver accounts being stripped out for hardship.

And accelerating bankruptcies.

A recession is not any route to housing affordability. If only the RB understood.

These "families underwater" bought $1.5 million houses with a $1.35 million debt at a time when anyone paying attention knew that Auckland houses were well overvalued.

More fool them.

I was living in NZ in 1990 when there were tumbleweeds blowing down the streets-property has never been a one-way bet.

I think you mean “if only this government understood”.

I thought only ACT were that cruel.

Hope that situation never happens to anyone close to you.

This is a sustained recession. All indicators except Dairy down or flat.

Manufacturing. Vacancies. House values. Car and machinery sales. Emigration. Construction. Salaries and wages. Savings.

Rates and charges up. Power bills. Groceries. Food bank collapses.

No time to cheer peoples' misery in any form.

I'm not cheering anybody's misery. I'm saying that buying a house is a risk that sometimes doesn't work out.

It is the same with Kiwisaver-people don't realise, or at least until recently they didn't realise, that its value can go down.

I have a son in Upper Hutt who's house purchase price (bought about 7 years ago) is probably back to that purchase price now.

"A 20% deposit on new loans is hardly draconian" . . . well that depends on who you are talking to . . . For a bank at present you are absolutely correct – yes it may be less for those that are 'sorted', but then for those that are not, life is considerably harder than in some previous generations – think back to the Holyoake years, when earnings for big company and government department heads may have been 10 or even 15 times a starting wage. After WW2, savings for many returned servicemen were non-existent – modest houses were built by many to save money, with finance partly from State Advances. It was after that period that occupational superannuation became more common, supplementing government provided pensions with savings, typically 5% from both employee and employer, but government and larger companies provided better benefits (in the case of government that offset slightly lower earnings levels) with pensions that were based on earnings near retirement, and giving pension increases to match inflation. The increase in pay at the top to up to say 300 times minimum pay affected the ability of young people to afford a house or family – the average age at marriage has increased, and family size is restricted in part by ability to pay for larger families. Companies had to afford the higher levels of executive pay, and that meant lower earnings at the bottom, and while Kiwisaver was better than no retirement savings that was becoming more normal, setting minimum savings levels at 3% soon became the norm for the lower paid – they had trouble affording even that much. Then a later government allowed those unable to save for a house to break into Kiwisaver to pay a house deposit – even with both in a marriage working, saving is more difficult than it was for their parents . . . Even then, an increasing number of families find owning a home is beyond their resources, and affording rent also very difficult.

So we see higher ages for mothers when they first give birth, many families with both parents working, and increasing problems with affording a reasonable standard of living for many in retirement or 'early retirement' due to illness or disability. So yes there is very low resilience when jobs are lost – perhaps that is why 40-odd thousand have left for better prospects in Australia. They have higher taxes than we do – perhaps that is why they can absorb economic refugees from New Zealand . . .

The influx of cash they fisted the banks who promptly plowed into mortgage lending has a lot do do with the rapid increase in house prices we saw towards the end of covid (and the subsequent increase in mortgage size).

Add that to reacting too slowly to the economic recovery and continuing to pour money into economy lead to fast rising inflation then having to lift the OCR quickly and to quite high levels to put a lid on it have left a huge mess.

Higher interest rates sucked a huge amount of money out of the economy with such large mortgages at play.

The loss of equity has swallowed up any borrowing headroom for renovation say a new bathroom or kitchen, carpet, landscaping take your pick really.

It will takes years for the Auckland economy in particular to recover could even take a decade.

Adrian Orr really shat the bed imo.

Yeah even 20 years ago New Zealanders were far less indebted than they are now.

Here's New Zealand's total mortgage debt since 2004:

Banks: Assets – Loans fully secured by residential mortgage, by time until next repricing (S33) – Reserve Bank of New Zealand – Te Pūtea Matua

The growth in mortgage debt is utterly enormous. Now granted about 1/3 of New Zealanders have a house with no mortgage. They are where they are and they will stay there.

But in a low-wage economy like ours, houses have for multiple decades been the only way to get wealth beyond what their parents' level was.

And in this economy there is still regrettably no alternative. Other than to give up and fly off.

Liam Dann today (paywalled) says house price falls in Auckland and Wellington are "catastrophic". He supports the stress testing carried out by the RB that has resulted in 20% deposits-this has effectively saved the banks from disaster. Good work RB. AS Crickle says below, the real damage was done by the greedy banks not the RB.

"Meanwhile, in Auckland and Wellington, there has been a wipeout on a scale that used to panic the Reserve Bank when it imagined catastrophic scenarios to stress test the financial system. Values in Auckland now sit 19.7% below the nationwide peak of January 2022. Home values in Wellington City are 27.3% below the nationwide market peak. Okay, we should acknowledge that the peak in 2022 was exaggerated and artificially inflated by Covid stimulus. … you can call it a phoney boom.

A decade ago, when house price rises were in overdrive, the RBNZ ran stress tests that looked at the impact of house price falls of both 20% and 30% on the banking system. The concerns it had about banking industry risk led to the development of stricter lending criteria – devices like loan-to-value ratios and debt-to-income ratios.

It’s fair to say they did the job. Banks have survived this historic downturn unscathed."

https://www.nzherald.co.nz/business/this-isnt-a-housing-market-meltdown-its-a-full-blown-crash-liam-dann/AAK7PHXITZFLJPYIBXU4MNLNPM/

The Right love to blame Adrian Orr for everything. It's laughable.

One of the main reasons house prices rocketed such that they became unaffordable for the masses, was favourable tax treatment, mostly promoted by the Nats, the very people now trying to push the blame for house prices crashing on to Orr. (Read the report I refenced above.) The Nats created this speculative bubble that at some stage was bound to pop….it's their own fault.

Labour to their credit tried to slow the speculative bubble with measures such as the 10 year Bright Line Test, though they are also partly culpable. A few years ago the Greens were pilloried by National for saying that house prices needed a major correction so that more people could afford to live in their own home. That was the climate fostered by the Nats, not the RB.

Sure, but theres no denying the Adrian Orr lead Reserve bank took 'money' or leeway provided by the Govt to keep the economy afloat during covid and instead of targeting it they basically let banks use it as they wished.

So yeah the RB has its share of blame, but rather than political parties, I'd suggest the main problem is the banks they have a deeply vested interest in property prices rising after all the bigger the loan the bigger the interest payments and of course much larger profits which are very much evident.

The banks acted in a way which was to be expected Adrian Orr was naive at best.

Also you've decided to ignore the fact that we saw unprecidented house price increases under rhe last Labour govt.

The standout years for significant price growth were 2019 to 2022, with the national average asking price increasing by almost 40% over this four-year period.

I said Labour were partly culpable above.

The residential construction has fallen through with the questions on the CGT too. In Ireland to get residential construction to correct a housing cost crisis they removed the CGT for "exißtinh home owners" with a mortgage if they moved into the new home.

7 years with no CGT doubled the housing supply in Ireland and doubled home ownership. They also removed tax on locally produced building supplies. Halved the cost of housing in 7 years.

Australia and the US have this issue where only retirement plans build apartment buildings for insured long term investment with stable income and the CGT is a tax on sale and they never sell.

Australia they spend money on their home, look at the number of swimming pools and size of their houses.

Ireland currently has the 6th-highest CGT among 35 major European countries.

https://taxfoundation.org/data/all/eu/capital-gains-tax-rates-europe/

You’ve provided zero evidence for your (too) many (too) specific claims.

What is remarkable is just how little impact this has had on the governments poll numbers. The male heavy construction industry would have been a big supporter for National and it's pack hounds in the 2023 election.

The economic consequences of this decision don't appear to have registered with the voters to much extent. For many, it is – still – the previous governments fault because 'they spent too much'.

This has not yet changed to 'maybe spending too much isn't as bad as not spending enough'.

Thing is most in the industry saw it coming. Its always been a boom bust industry and the bigger the boom the bigger the bust.

I work in the tail end of the construction of massive architecturally designed residential new builds (10mil +) and could see the crunch coming, the top end architecture firms experienced a crash in enquiry as the build costs went through the roof towards the end of covid. Takes a good three years from initial concept through to job completion in the particlar niche I work in.

This bust is bad far worse than GFC.

Ad it was not Adrian Orr alone. People are greedy. A home is not enough, must have a bach a couple of rentals all funded on borrowed money during low interest times.

To expect a starter home to be 4 bed 2 bath double garage, in a time of smaller families was a problem imo. Not to mention 2 cars the huge tv Gaming consoles tablets laptops and mobiles. Essentials have sure changed.

By the way NZ’s first LTV was 2013 in Key’s time.

We always want more even if it threatens the system.

I cannot for the life of me understand why the hard left like you always impute greed when New Zealanders take on a mortgage to get a first house.

From the contempt you show to the young I can guaranteed you're old and just fine.

Kiwis that still have the incredible bravery and tenacity to take on a first mortgage in this economy sure ain't the 10% who own about 50% of our entire wealth.

(and about 50% of us can barely scrape together 2% of New Zealand's wealth between them)

No, they are from the 90% of New Zealanders who actually own stuff-all but scrape something together and take it to a mortgage broker. They want somewhere to live and honestly any government with a damn would help them.

That's not greed. Don't forget what Norm Kirk said.

Spot on Patricia. Comrade of the hard left. I don't blame landlords personally, the pollies of all stripes keep that scheme going.

I don't blame landlords personally, the pollies of all stripes keep that scheme going.

It's worthy of consideration, when does success tip over into greed. How much is enough?

If someone wants a bigger slice of the pie, someone else must have less.

Home ownership is a bedrock to so many things beyond wealth. A turanga wae wae, a building block of communities for example.

Yes gsays, Ad did not own the greed factor. Yes I am Red Green and also see merit in Te Parti Maori.

We have a small 2 bedroom unit a 2006 Toyota Ractis (it takes a walker or wheelchair) We do have a half teachers' pension plus the normal pensions for 2 people.

We were middle management who lived through the 1987 crash, the GFC and Key's sinking Lid on things thanks to Bill Birch.

A son who did long study to find his "help people niche' and another gay son, a Trade Cert Baker who "threw" 70KG bags of flour "like a dancer", his brother's description. Brilliant loving and loved people.

We are not as Ad imagines us. One has a home the other doesn't. We get it.

However, anyone who thought low interest rates were a signal to buy bigger, did not read the signs. imo Builder or buyer.

My point is a small starter home of three bedrooms with one attached garage requires a much smaller loan. The profit margin is not as high of course for the builder.

Our family always thought health love family friends and togetherness were far more important than what you owned. But that is our choice.

A friend of mine has that model of car…she calls it her Toyota Racist.

We call ours "The Tardis" Back seat built for small people, but the hatch opens the whole back, and with the back seats flat a 2m x2.5m area. Great city car for parking and higher seating easier for octogenarians.

What was the rationale for NatActFirst tanking the construction industry? It doesn't make much sense to me politically, given that a very large proportion of the workforce favours the right. Thoughts on this?

The other thing that concerns me is that the scale of the crash and the large percentage of the workforce that has up sticks to Oz will mean that building costs and wages will inflate quickly when there is more money to spend in the future. The supply side issues that were already bad will only get worse.

On the minimum wage front and this is totally anecdotal from my own individual perspective. I simply can't afford to pay for small building jobs because the price has inflated out of reach for me. Everything has to be DIY and I've become a dab hand at using ChatGPT as my building tutor. I wonder to what extent the cost of labour has priced building out of reach of normal Joe Public.

"the cost of labour", plus council charges the cost of land and materials.?? It is never one thing, but this government has caused a cascade of problems. Personally I am sorry for the little guy and the middle guy, retentions get lost in liquidations and insurance is almost impossible, then when the build does succeed it is a lottery as to what the price plus interest ends up being, never mind adding rates. This is a "fire sale" economy, talked about in Jane Kelsey's book.

Understand it is a battle between those who have capital and those who labour (work). I have read passages on interst.co.nz where they are waiting for mortgage sales to pick up plumb properties cheaply. So boom and bust suits some sorted types. It is their garage sale. As long as they can do that, it is politicly expedient. Ask you chat GP for a chart of NZ's Boom Bust record in Building in NZ.

Say since 1974 the end of the Government State Advances 30 year loan. It was $10400. our section was $3200. We had a second mortgage of $5000. That was a Peerless home in 1973. Our combined incomes were $8000 a year from the year of the build. We paid the $5000 2nd mtg over 5 years. We had to have 10% of the house price. Altogether it was a third of the price with costs. We were 32, the boys 6 and 8.

Forgot to say we had to own our section to qualify for the loan, plus have the 10% of the house cost and the lawyer fees, insurance and first quarter of the rates. Our section took 6 months to go through the Maori Land court.

Kiwis earning minimum wage are probably in a similar bind – sorted don’t care.

Aotearoa minimum wage: $23.50 per hour.

Australia minimum wage: $24.95 per hour = NZ $26.90.

Still less than NZ’s living wage (NZ $27.80), but not by much. Australia anyone?

So basically according to this article is nationals fault for turning off the money hose on some ridiculous spending. Three waters never started and was always going to be cancelled not only was it inefficient but also race based. The current solution of encouraging councils to unite into bodies and sort out their own infrastructure using cheap loans is far more fair to the entire country. Especially when this is a core fundamental councils should focus on instead of cycle ways, playing with speed limits, funding Cadbury projects and parades.

People always bring up the so called land Lord tax break as some sort of smoking gun which it wasn’t. It was just righting a wrong that for some reason meant landlords unlike every other type of business suddenly had to pay taxes even if their business was taking a loss and due to the massive inflation caused by the previous government’s criminal level of incompetence those losses were quite substantial compared to what they were previously and rents were sky rocketing to pay for it (every metric shows they have now stopped shooting up).

Then you have the criminal incompetence of shutting down the oil and gas industry ensuring we are now reliant on coal and this caused our power prices to shoot through the roof, every other country thinks gas is a great transition fuel but NZ decided to go for Indonesian Coal instead.

Then you have people who complain that the minimum wage needs to go up because things are too expensive. Yet don’t seem to understand that if you pay people more prices need to go up to pay for the salaries and you are no better off then you were before with the higher inflation. People always try to argue this is not the case however you just need to look at the well documented fact that even with labours huge minimum wage increases, buying power for each dollar earned had dropped since the Key government well before the current government came into office.

You really need some mental gymnastics to blame the current state of affairs on the current government and not the last government. Its a lot quicker to drive a car into a ditch than it is to get it back out again and you have only given the government 18 months and now want to go to a Greens, Maori and labour coalition to some how “fix” everything…. Now that’s what I call being divorced from reality

Another idiot ignorant of basic economics and geology. Lets start with the latter. Where do you brainless parrots get your talking points from? Real stupid radio?

There hasn’t been a commercially viable oil or gas field discovered in about 4 decades. That is despite extensive search drilling from over nearly 5 decades. The last viable discovery that I’m aware of was the Tariki / Ahuroa field that was discovered in 1986, and production started in 1996. It is now largely depleted, but still has some gas in it with significiant engineering costs. It has been used as a gas storage facility for decades.

It usually takes decades to get offshore fields productive, and because of NZ’s fractured geology we haven’t found more than minor fields onshore. We’re not even that likely to find any more exploitable fields offshore (my first degree was in Earth Sciences including a lot of NZ geology), most possible basins have now been surveyed. Try reading this piece from an drilling supportive engineers perspective. https://theconversation.com/nzs-gas-shortage-was-not-caused-by-the-offshore-exploration-ban-but-it-was-still-a-flawed-policy-242013

Suffice it to say that the rest of your ‘arguments’ show the same level of ignorance.

Even if your analogy was correct, which it is not, the obvious counter is that National and their parasitic partners are sitting in a ditch spinning their wheels and hoping that some miracle will pull them out. They have managed to depress every sector in the NZ economy with recessionary policies that causes both a lack of business confidence and a massive increase unproductive unemployment.

At present they are flailing around playing the same lazy culture war themes that you are using. While doing that and doing absolutely nothing to increase productivity. In fact they seem to be concentrating on reducing productivity with culture war actions like severing the efficient use of cook strait transport with a massive unload/load/unload/load from rail to trucks to ship to rail.

Basically the only sector of the economy that is doing at all well at present is the nearly raw commodity sector of pastoral farming – the industry with low direct and indirect employment, massive export revenues, piss-poor profit margins, and a debt-laden producers. The money from that isn’t going into the economy in any quantity. It is going into paying off debt and enriching offshore banks and shareholders. You can see it when you look at where business and personal taxes come from – made on profits. The state probably gets more tax income from university students work income. There is an exercise for you – prove me wrong.

Projects such as the light rail, where millions have already been spent on feasibility studies and groundwork, should be completed. In some areas, we can see half-built bridges and idle cranes—these represent a huge loss if projects are abandoned midway.

While we understand that New Zealand is still recovering from the impacts of COVID and ongoing economic instability, there is also an opportunity. With so many graduates coming out of our universities and technical institutes in fields such as construction, engineering, and architecture, we should be focusing on generating employment through projects in infrastructure, mining, and manufacturing—always keeping environmental protection in mind. This would not only help retain our workforce but also generate revenue locally.

What is urgently needed is a reduction in red tape and bureaucracy. Too often, millions are spent on reaching decisions, but that money never makes its way to the frontline—workers such as police, nurses, teachers, and those in construction, who are the backbone of our communities.

The problem with calls to “reduce red tape and bureaucracy” is that people usually mean “reduce it for the things I like, and keep it for everyone else.” The same voters who moan about road cones are often the first to complain when their council doesn’t personally consult them about removing a couple of car parks for a cycle lane outside the local school.

We can either have robust public consultation that allows everyone’s voice to be heard, or we can get out of the way and let experts get on with building the infrastructure we desperately need. You can’t have both.

Right now we’re stuck in the worst of both worlds: endless consultation that produces no consensus, and no trust in expertise to actually deliver.

Our productivity problem isn’t red tape, it’s a failure of imagination: an economy addicted to property speculation, and a culture of letting NIMBYs and blowhards derail every major investment into pointlessness.

Light rail in Auckland could have been built years ago. Instead, we’re held captive to letters-to-the-editor, culture war bullshit to justify squandering our transport funds on moar roads, angry mobs of “concerned citizens,” and unscrupulous politicians willing to mortgage our future for short-term gains.

If jacinda Arden didn’t spent so much tomorrow’s money and leave NZ in so much debt, national does not need to cut so much budget. This is all because labor party did a s*** job.

Another twit from the world of Real stupid radio… They are coming in as thick as a flea today.

Clearly you don’t have much of an idea about our debt levels. For instance that Nicola Willis, now in her second year as finance minister has higher public debt levels than any of the previous 6 years of Labour. Sure she has projected reductions in national debt compared to GDP (it removes variables like inflation and global economic issues) but they only start in 2028.

But those are projected rather than measured. Last year she was projecting debt reductions in 2027 – before she trashed the economy last year. At least Labour had a valid reason like a pandemic. National is just acculmulating deby through incompetence at controlling the economy.

See https://www.statista.com/statistics/436529/national-debt-of-new-zealand-in-relation-to-gross-domestic-product-gdp/

The second way to measure national debt is against other economies. So if you look at the central government debt % vs GDP in 2024, like this comprehensive list in wikipedia https://en.wikipedia.org/wiki/List_of_countries_by_government_debt#Government_debt_as_a_percentage_of_GDP

you will find that NZ doesn’t have a lot of debt. At 47.4%, we have less than Singapore (175.2%), United States (121%) France (111.6%), United Kingdom (101.8%), China (88.6%), Finland (81.4%), Germany (63.7%), Australia (49.6%), and we are even not too bad compared to oil-rich Norway at (38%).

Basically, you’re just talking complete shit. Probably because you’re unproductive layabout who is too lazy to do anything except parrot someone else’s false bullshit.

You were compelling, informative and believable until " just talking complete shit. Probably because you’re unproductive layabout who is too lazy to do anything except parrot someone else’s false bullshit" where you lost all credibility with a juvenile attack – and lost my interest entirely.

If you’ve been a bit more mature, you really would have changed my mind entirely [from my usual “None of these pollies know what the hell they’re doing” attitude]

You don’t like clear opinions about other people’s comments expressed? Why?

I presented a argument, with links and some work, about exactly why I thought that’K’ was writing complete crap. Your response is that I should be polite about an idiot parroting misinformation?

Even more hilariously, your comment lacks a few essentials for a robust debate – the purpose of having this site. For instance a cogent argument about why my behaviour was problematic would be useful. Instead you just made an assertion without any reasoning, even of the basis of your own response.

Demonstrating why I should value your opinion would help. Instead you just whine like a 1950s housefrau complaining about her neighbour having a life beyond housework and babies. You haven’t even said why you found the quoted statement of my opinion is not ‘mature’. It was a quite deliberate insult pointing out my opinion of another argument. Just as this one is.

You appear to be a lazy whiner who reacts to tone rather than using your brain to thinking about your own reasoning.

That attitude probably explains your “None of these pollies know what the hell they’re doing” as well. From what I have seen, most politicians typically do a great deal of work and significiant amounts of thinking about what they are trying to achieve – even the ones I completely disagree with.

From what I can see of you so far, you haven’t lifted a finger to figure out what you’d like them to do. It also doesn’t sound like you’d have ever gotten involved in doing anything to change what they are doing.

You aren’t even an adequate critic.

Thanks K. By international standard and compared to our economic peers we have very low levels of government debt to GDP.

Drowning in a sea of red ink even, but these are merely perspectives – spot Aotearoa NZ.

Was working in construction when mortgage rates went crazy and people stopped ordering house builds. We had a bit of a lag with signed contracts in the pipeline but with inflation going nuts too, margins were squeezed down to virtually nothing and the company had to lay off more than half the staff, with more going later. This was well before National was elected. There was obviously an impact on suppliers to the company too with layoffs for them as well.

That would have been post the pandemic lock downs? Essentially 2022 and early 2023? You can see that effect happening in residential consents. For instance – Auckland Residential. But most places in NZ show the same effect across all.

https://sl.bing.net/hZt29ISiqrI

There was no doubt that the inflationary and supply constrained post-pandemic was squeezing the construction industry. Which was why the government of the day was pushing both housing and infrastructure projects into the pipelines to reduce the economic impacts over post-inflationary period in 2023-2026

In 2022/3 Kainga Ora and other government building programs were starting to get massively increase in a counter-cyclical government response.

First thing that National’s government did was to expensively shut down that pipeline for everything from the construction for cook strait ferries, to school upgrades, to public housing. Pretty much all within the first 100 days.

That left 2024 with virtually no new construction work coming into the pipelines. There is even less coming in now because there are no clear indications from this government about their future construction intentions. The effect is to dismantle the construction workforce skills and send them offshore or out of the industry, and a lot of the supply chain disruption.

The post isn’t about when the construction industry started busting. That is pretty well known. More about why it is continuing to drop without any concern from this government.