class war

Categories under class war

- No categories

Davis on iwi-run prisons

Written By: - Date published: 10:00 am, April 16th, 2010 - 37 comments

Kelvin Davis: It goes to show how high the aspirations of some of our Maori leaders are. We now aspire to bung the bros in the hinaki and watch the dollars roll in. The longer and more often we can put them away, the sooner we will be able to afford to expand the prison and lock even more away. With the soaring crime rate and high Maori unemployment everything is coming together nicely.

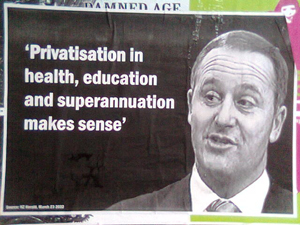

The privatisation push

Written By: - Date published: 7:35 pm, April 14th, 2010 - 99 comments

National has announced the location for its first private prison on the same day we find out that they want their working group to look at privatising welfare. Private prisons were signaled by National. Privatising welfare was not. In both cases the victims will be a segment of society that this government and its supporters have actively vilified and the ones with the most to gain will be overseas corporations.

Take it out of my ‘tax cut’

Written By: - Date published: 9:22 am, April 9th, 2010 - 30 comments

So the govt wants to sue the Waihopai 3 for $1.1 mil. No pesky jury this time. The dudes only have a grand between them. Spending a couple of hundred thousand on lawyers’ fees to bankrupt some hippies. Doesn’t seem like the best use of taxpayer cash. Tell you what. If the govt really wants its $1.1 million they can take it out of our tax ‘cuts’. 25 cents each. That’ll be my tax cut pretty much gone.

Tax hikes fail to cause ‘brain’ drain in UK

Written By: - Date published: 10:19 am, April 8th, 2010 - 39 comments

George Monbiot writes: It’s a bitter blow. When the government proposed a windfall tax on bonuses and a 50p top rate of income tax, thousands of bankers and corporate executives promised to leave the country and move to Switzerland(1,2). Now we discover that the policy has failed: the number of financiers applying for a Swiss work permit fell by 7% last year.

Sticking it to the underclass

Written By: - Date published: 9:30 am, April 7th, 2010 - 39 comments

Remember “the underclass”? They were briefly fashionable in National circles in 2007. Now that they are the government National’s policies for the underclass seem to involve a good deal of beneficiary bashing. Invalids are being thrown off their benefit before the new legislation is even in effect. Election promises are being broken to remove the carrot and wield the stick. How will this help the underclass?

Scott on crime stats

Written By: - Date published: 5:23 pm, April 6th, 2010 - 14 comments

I think they know full well what causes violent crime.

They just don’t care.

Jobs only real benefit reduction policy

Written By: - Date published: 9:02 am, March 24th, 2010 - 18 comments

You can’t ‘force beneficiaries back into work’ by ‘giving them a kick in the pants’ if there’s no jobs for them to go into. This supposed ‘get tough’ approach won’t get people off the benefit. It’s a cynical exercise in political marketing to make the government look active and distract from the real issues. It is no coincidence that this policy was released a day after the mining policy.

Bennett slaps solo parents

Written By: - Date published: 1:53 pm, March 23rd, 2010 - 157 comments

Paula Bennett and John Key have announced they’re getting tough on beneficiaries.

What a pity they couldn’t put the same energy into saving a few jobs in the first place.

One in five children

Written By: - Date published: 6:18 am, March 22nd, 2010 - 28 comments

Anne Tolley has promised that national standards have been introduced so that “every single child could read, write, and do maths when they left school”.

The depths of arrogance and ignorance in that claim leave me at a loss for words…

I got it wrong: tax cuts for rich even bigger

Written By: - Date published: 12:09 am, March 22nd, 2010 - 100 comments

I made a mistake in my calculations of the effects of the leaked tax reforms. In the corrected numbers, the poor get less, the rich get more. The wealthiest 13,000 taxpayers get a quarter of a billion in tax cuts between them – nearly $20,000 a year each. The poorest half $1.25 a week and higher rents to pay. This ‘tax reform’ package is really a mask for a wealth grab from the many to the few.

Tax cut bizzaro world

Written By: - Date published: 12:20 pm, March 14th, 2010 - 16 comments

Under National’s proposed tax cuts and GST increases someone on the average wage of $48,000 comes out about $5 to $10 per week ahead. But 70% of Kiwis have incomes under $40,000. Their tax cuts will barely compensate them for the GST increase. How can National go on claiming that “the vast bulk of New Zealanders will be better offâ€?

Armstrong and class interest

Written By: - Date published: 10:56 am, March 6th, 2010 - 28 comments

The poor don’t need tax cuts for the top 12% to to inspire them to want to get out of poverty. Poverty is inspiration enough. But thepoor cannot all become rich. To function capitalism needs poverty. There’s got to be lots of people doing the shitty, dangerous, hard jobs for cheap. And the wealth will always flow to the elite few who own capital or defend their interests.

O’Sullivan and Garrett, strange bedfellows?

Written By: - Date published: 10:37 am, March 6th, 2010 - 6 comments

Fran O’Sullivan is a pro-business liberal or libertarian, David Garrett is a knuckle brain conservative. But actually, they’re not so far apart. It seems both believe in freedom for the rich and control over the poor. Incredibly O’Sullivan goes into bat for Garrett over his sterilisation comments.

Kick in guts for recesson victims

Written By: - Date published: 9:59 am, March 3rd, 2010 - 10 comments

The recession has forced tens of thousands of people out of work. There are now 276,000 jobless Kiwis. The lucky ones (only a third of the officially unemployed) can get the unemployment benefit. Now, the Government is letting inflation eat into their meager benefit payments. Benefit payments are meant to be adjusted for inflation. This […]

Stupid greedy voters – Brash

Written By: - Date published: 8:07 am, March 1st, 2010 - 50 comments

With true tory arrogance at the ACT conference this weekend, Don Brash has described New Zealand voters as venal and stupid.

Apparently New Zealand’s reluctance to destroy what is left of their society by implementing Brash’s discredited crazy old man economic voodoo is a sign of their stupidity.

Apparently nobody in ACT disagreed with him. Go figure.

MMP campaign heats up

Written By: - Date published: 12:39 pm, February 17th, 2010 - 30 comments

The business elite wants to drag us back to the days of unfair elections and weak democracy, when business interests held even more sway than now. We don’t want to return to those days. We want to keep the best electoral system in the world – MMP.

Public: GST should pay for cuts to bottom rates

Written By: - Date published: 12:03 am, February 17th, 2010 - 16 comments

Key doesn’t have the money to keep his promise to make everyone better off or at least no worse off from tax reform. He doesn’t have pixies in the garden to make more money. But he can cut the bottom tax rates, and a new poll shows strong support for that move.

Right turns a blind eye to middle NZ

Written By: - Date published: 9:30 am, February 16th, 2010 - 62 comments

In their attempts to justify putting up GST on all New Zealanders to give huge tax cuts to the wealthy few, the Right are going so far as to argue that middle and low income New Zealand doesn’t even exist.

Key confirms: tax up for middle NZ, down for rich

Written By: - Date published: 9:30 am, February 15th, 2010 - 54 comments

Key has explicitly promised that no-one will be left worse off by these changes but he doesn’t have the money, can’t have to money, to do that if he persists in handing over buckets of money to the rich.

Economically incompetent ACE cuts

Written By: - Date published: 1:00 pm, February 13th, 2010 - 35 comments

National love to tell us what we want to hear. Among their many pre-election policy lies they waxed lyrical about the value of education, before effectively cutting funding in the budget. On Adult and Community Education (ACE), Bill English was particularly supportive…

A fair tax

Written By: - Date published: 9:28 am, February 13th, 2010 - 38 comments

Click through for today’s Tom Scott cartoon.

He hits the nail on the head.

Putting up GST hits the poor the hardest.

For Kiwis who are barely scrapping by every cent counts.

The Right’s blindness towards middle New Zealand

Written By: - Date published: 7:44 am, February 11th, 2010 - 100 comments

I find it frustrating that the debate over tax concerntrates on the top rate rate, which doesn’t apply to 90% of taxpayers. It’s as if the Right, and many in the media, are either blind to the existance of people on normal incomes or severely underestimate their number. John Key, of course, is the worst. […]

Translating Tories: “Incentives to get ahead”

Written By: - Date published: 12:58 pm, February 3rd, 2010 - 49 comments

This is the first post in an occasional series that will translate Tory speak into plain language (fellow writers and guest posters are welcome to play!). Today’s exhibit is this corker from the Double Dip: “Finance Minister Bill English today confirmed Budget 2010 will be delivered on May 20 and will set out important policies […]

Wages dropping under Key, as promised

Written By: - Date published: 11:26 am, February 3rd, 2010 - 28 comments

Remember how John Key said he “would love to see wages drop“. You might remember the big corporate media refused to run it, and the head of APN held an emergency meeting with Key then pressured the journalist who had reported the comments to retract them, which he would not do, and then APN published […]

Nats soft on crime

Written By: - Date published: 10:36 am, February 2nd, 2010 - 38 comments

Oh, sure, the Nats will lock a person up longer after they commit a crime, if they get caught. But what they won’t do is prevent them commiting the crime in the first place. National will spend a fortune on counter-productive vengence after you’ve become a victim of crime but not a fraction of that on saving the crime from happening in […]

Minimum wage myths: unemployment

Written By: - Date published: 9:15 am, February 2nd, 2010 - 127 comments

One of the old saws that the Right brings out whenever the topic of increasing the minimum wage comes up is ‘oh no, it will increase unemployment’. They said it this year. The Business Roundtable said it every year as the Fifth Labour Government put up the minimum wage and unemployment kept falling. Hell, they […]

Tim Watkin slams tax cuts for tax cheats

Written By: - Date published: 12:18 pm, February 1st, 2010 - 16 comments

On the Q+A blog, Tim Watkin rips into the proposed tax changes. Part of the post: …You might think that such a new source of tax income would open the door for tax cuts for the poorest New Zealanders; after all, they struggle the most in tough economic times and spend a higher proportion of […]

Goff: no GST hikes or tax cuts for rich

Written By: - Date published: 11:06 am, January 29th, 2010 - 30 comments

In his speech yesterday Phil Goff articulated Labour’s position on tax in no uncertain terms and came out very strongly against wealthy tax dodgers : “Too many people on good incomes avoid and evade paying taxes. It’s not right that some top earners pay a lower percentage of their income in tax than those on the […]

Tax is the price the elite pay to maintain their privilege

Written By: - Date published: 10:27 am, January 23rd, 2010 - 53 comments

John Roughan asks: “Nearly half of all personal tax revenue is contributed by just 10 per cent of us. Is this socially healthy?” To which I reply: “That 10% get 34% of the country’s income and own 52% of the country’s wealth, compared to the 50% who get 16% of the country’s income and own […]

Questions of trust

Written By: - Date published: 4:30 pm, January 22nd, 2010 - 27 comments

Over at Red Alert Stuart Nash asks whether the details of property developers being investigated by the IRD will be released in the same way Basher Bennett released the benefit details of two solo mums. Bloody good point. I’d also like to know if the details of the fifty percent of the richest 100 people […]

Tax cuts for tax cheats

Written By: - Date published: 7:39 am, January 22nd, 2010 - 55 comments

The Right’s main justification for the highway robbery of cutting the top tax rate to 30% then funding it by increasing rents and charging the 78% of people who earn under $48,000 2.5% more GST is: ‘Half of the richest 100 avoid paying the top rate anyway. May as well reward them and all the ones who don’t rip us off massive […]

Recent Comments